In any accounting system, journals play a crucial role in recording and tracking financial transactions. Odoo, with its robust accounting module, offers a flexible and efficient way to manage journals, ensuring that your financial data is organized, accurate, and easily accessible. Whether you’re handling sales, purchases, cash transactions, or bank statements, understanding how to set up and manage journals in Odoo is essential for maintaining a well-structured accounting system.

In this blog, we’ll explore what journals are in Odoo, why they are important, and how to effectively use them to streamline your accounting processes.

What Are Journals in Odoo?

Journals in Odoo are essentially logs that record all financial transactions within a specific category or type. They are the backbone of the accounting system, helping businesses to track and organize transactions such as sales, purchases, cash movements, and more. Each transaction in Odoo is recorded in a specific journal, which is then used to generate reports, reconcile accounts, and maintain accurate financial records.

Types of Journals in Odoo

Odoo allows you to create and manage different types of journals based on your business needs. The most common types include:

- Sales Journal: Records all sales transactions, including invoices and customer payments.

- Purchase Journal: Tracks purchases and supplier bills.

- Cash Journal: Logs cash transactions, such as cash receipts and payments.

- Bank Journal: Records bank transactions, including deposits, withdrawals, and bank transfers.

- Miscellaneous Journal: Used for recording other types of transactions that do not fit into the standard categories, such as adjustments or internal transfers.

How to Set Up and Manage Journals in Odoo

Access the Journals Configuration

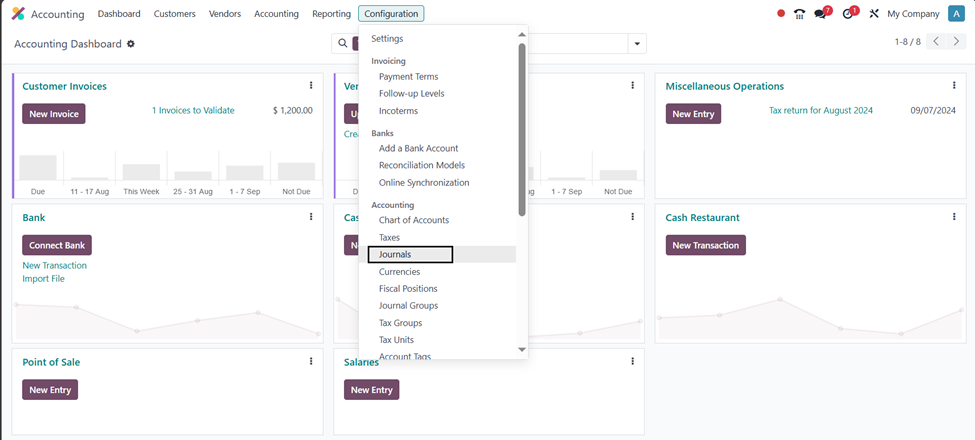

- Navigate to Accounting: In the Odoo accounting dashboard, go to the Accounting module.

- Configuration: Click on Configuration > Journals to access the list of existing journals or create new ones.

Create a New Journal

- Click on Create: In the Journals section, click the New button to start a new journal.

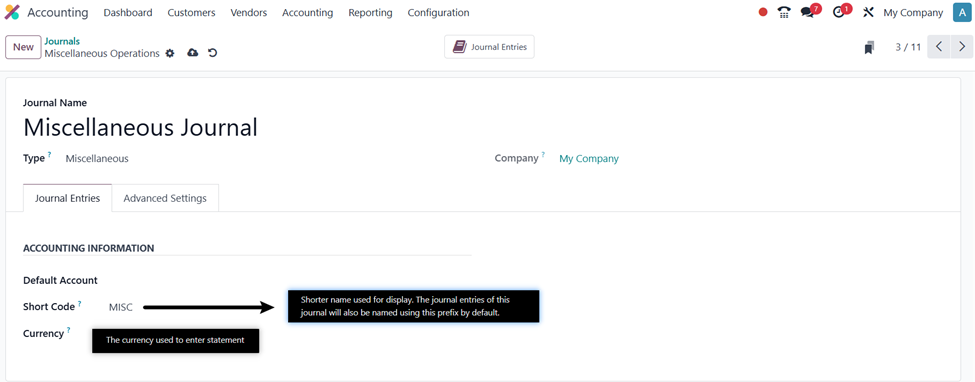

- Enter Journal Details: Provide a name for the journal (e.g., " Miscellaneous Journal"), select the journal type (e.g., Miscellaneous), and define other settings such as the default debit and credit accounts (Default debit and credit mostly use in Sales and purchase type of journals).

- Currency Settings: If your journal will handle transactions in a foreign currency, set the currency in the journal configuration.

- Define Short code: Give a short code that will be used as a voucher/sequence no in transactions.

Accounting Information

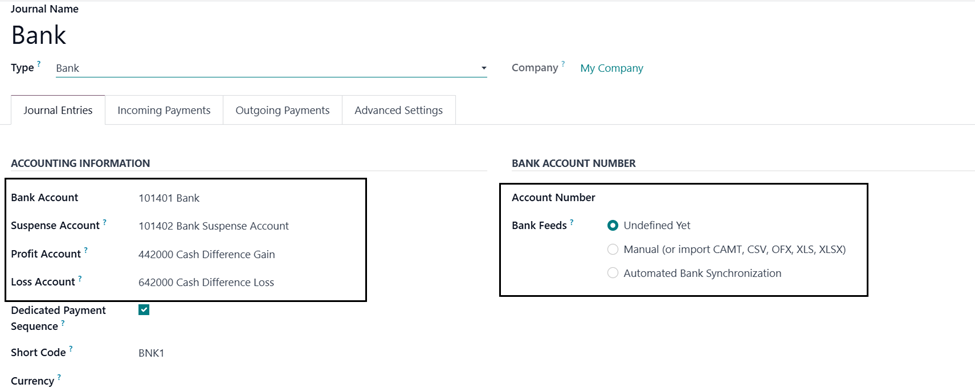

- Relevant Accounting Information: Define relevant accounting information in Bank journal type.

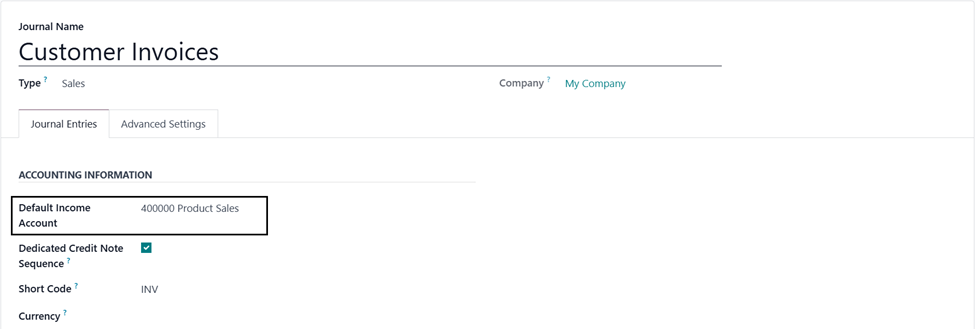

- Relevant Accounting Information: Define relevant accounting information in Sales journal type.

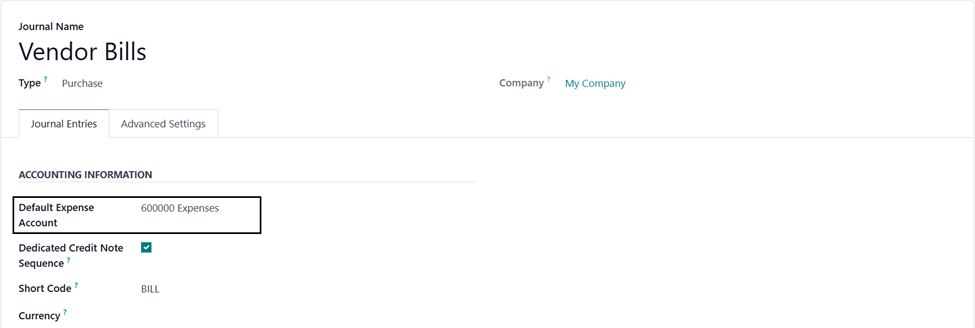

- Relevant Accounting Information: Define relevant accounting information in Purchase journal type.

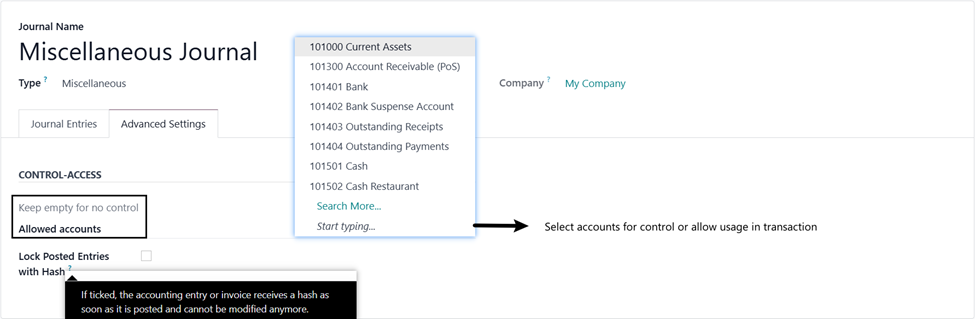

- Define Control Access: If needed, allow specific accounts to be used in journal or leave empty for no control.

Conclusion

Journals are a fundamental component of any accounting system, and Odoo provides a versatile and user-friendly platform for managing them. By effectively using journals in Odoo, you can ensure that your financial transactions are well-organized, accurately recorded, and easily accessible for reporting and analysis. Whether you’re managing sales, purchases, cash, or bank transactions, Odoo’s journals help streamline your accounting processes, improve financial accuracy, and support better decision-making.