In this blog, we’ll explore what is Chart of Accounts are, why they are essential, and how to set them up in Odoo.

What is a Chart of Accounts (CoA)?

The Chart of Accounts (CoA) is a complete listing of all the financial accounts used by a business to record transactions. These accounts are categorized by type, such as assets, liabilities, equity, income, and expenses, allowing for a detailed and organized recording of all financial activities.

Key Components of a Chart of Accounts:

- Assets: Accounts that track what the business owns, such as cash, inventory, and receivables.

- Liabilities: Accounts that track what the business owes, such as loans, accounts payable, and mortgages.

- Equity: Accounts representing the owners’ interest in the business, including retained earnings, capital stock, and other equity investments.

- Income: Accounts that track revenue from sales, services, or other income-generating activities.

- Expenses: Accounts that track the costs of running the business, such as rent, utilities, and salaries.

- Cost of Goods Sold (COGS): Accounts that track the direct costs related to the production of goods sold by the business, such as raw materials and labor.

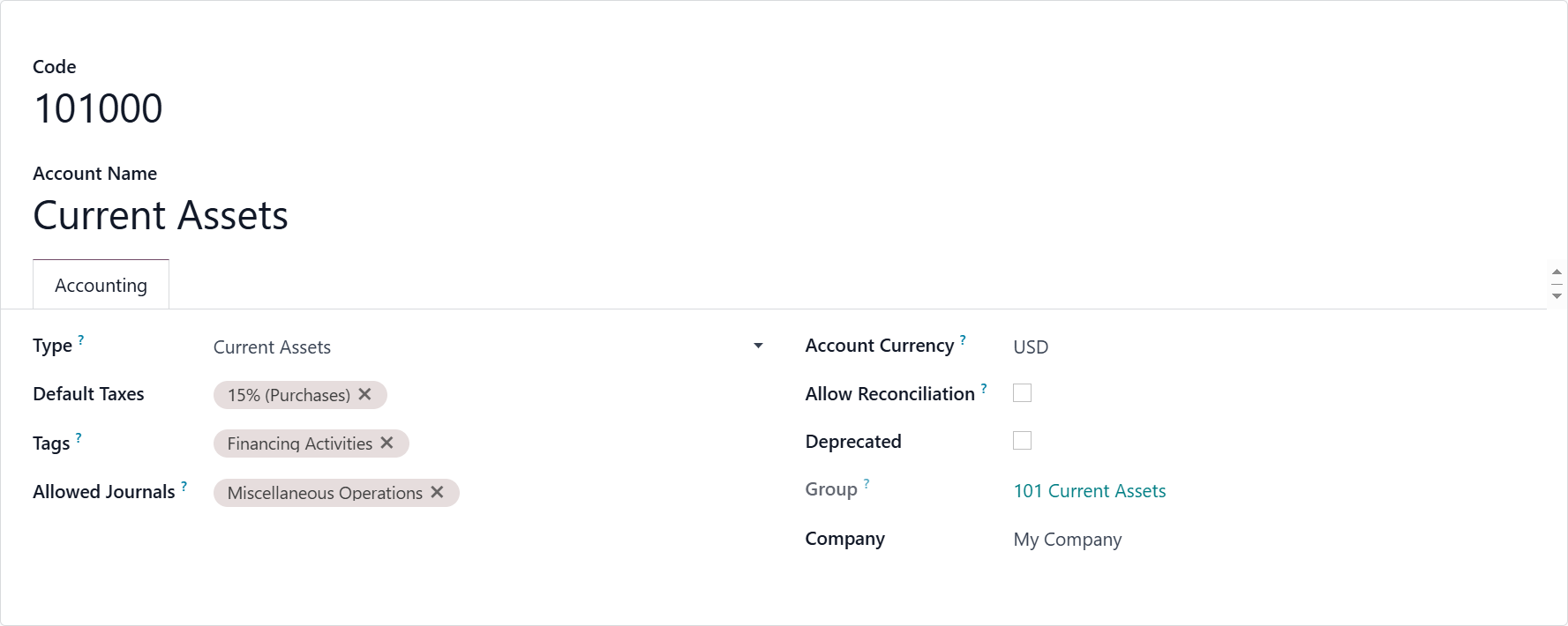

Key Fields to Complete in a Chart of Accounts:

- Account Name: The name of the account, which should clearly describe its purpose, such as "Cash on Hand" or "Accounts Receivable."

- Account Code: A unique numerical identifier for the account, which is essential for easy tracking and reference.

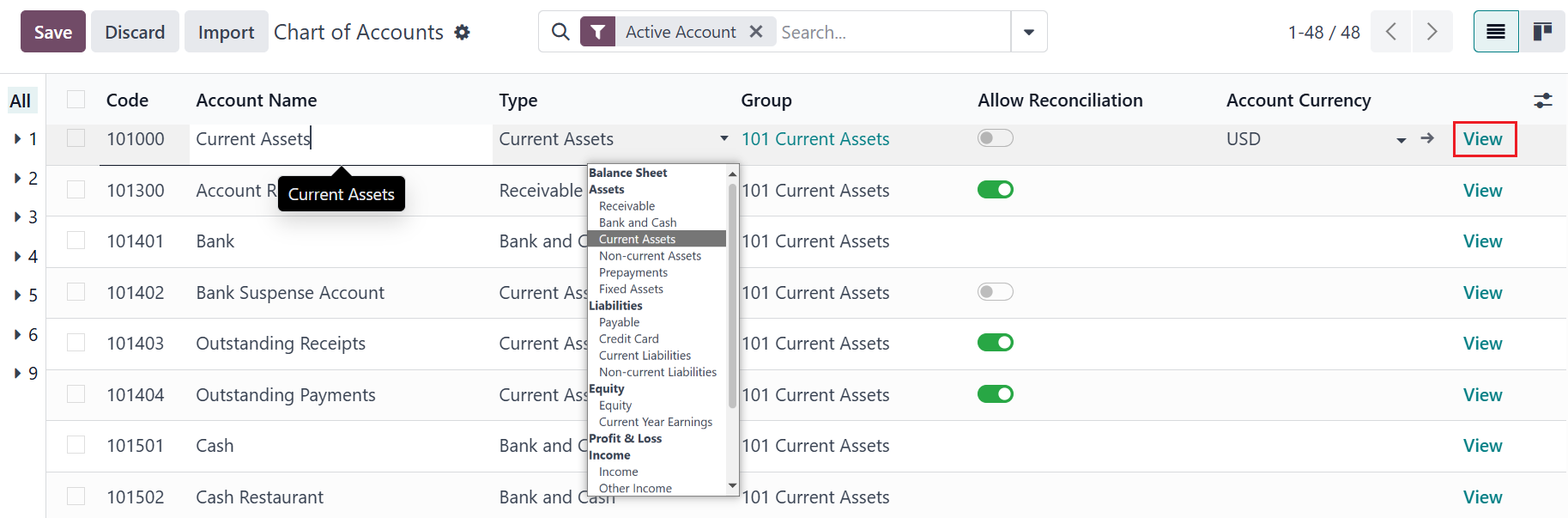

- Account Type: Defines the category of the account, such as Asset, Liability, Equity, Income, or Expense. This classification helps in organizing the Chart of Accounts and generating accurate financial reports.

- Default Taxes: Specifies the tax rates associated with the account. For example, sales accounts might have a default sales tax applied.

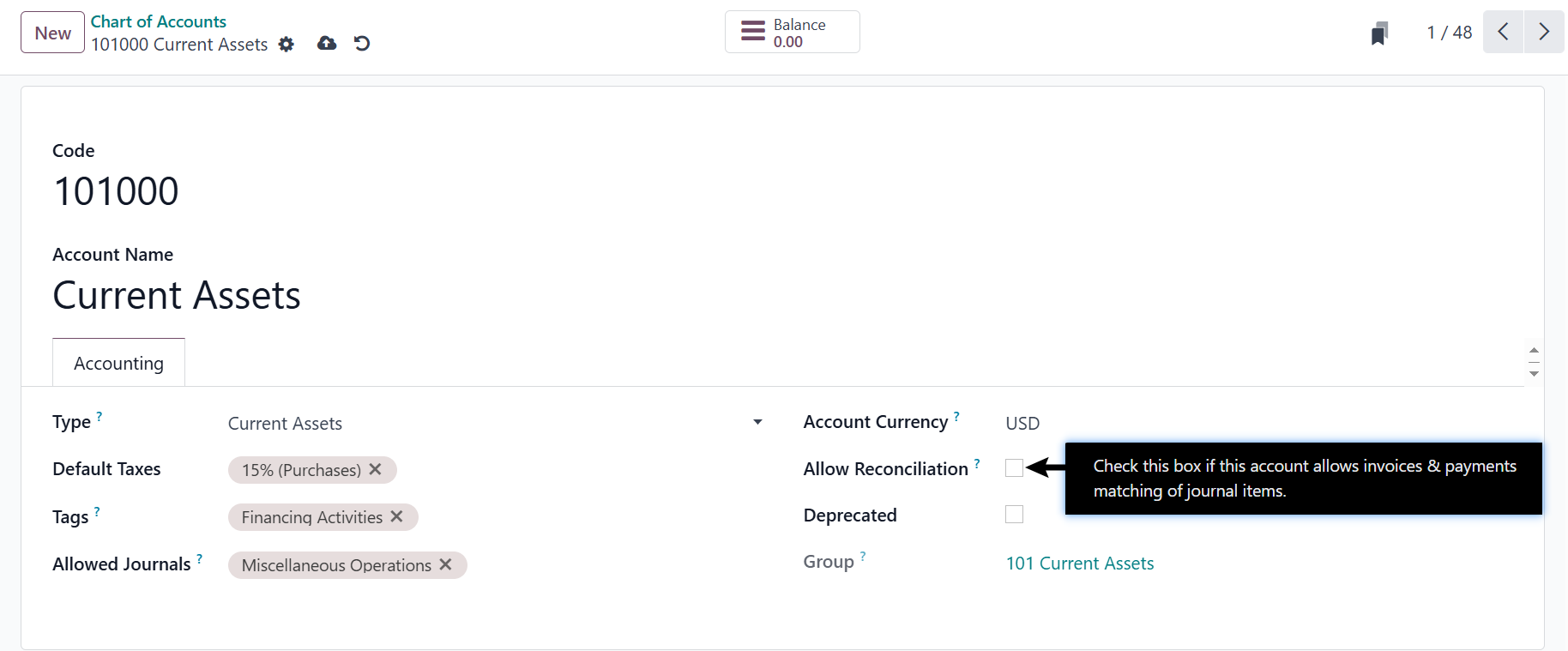

- Allow Reconciliation: A checkbox that, when enabled, allows the account to be reconciled. This is typically used for accounts like bank accounts where you need to match transactions with bank statements.

- Tags: Tags are used for further categorization and reporting. You can add relevant tags to an account to make reporting more flexible.

- Account Group: Assign the account to an appropriate group, such as "Current Assets" or "Operating Expenses." This helps in structuring the accounts logically.

- Deprecated:

It is not possible to delete an account once a transaction has been recorded on it. You can make them unusable by using the Deprecated feature: check the Deprecated box in the account’s settings, and Save.

- Currency: If your business deals with multiple currencies, you can specify a currency for the account.

- Company: If you manage multiple companies within Odoo, specify the company associated with the account.

Configure Chart of Accounts

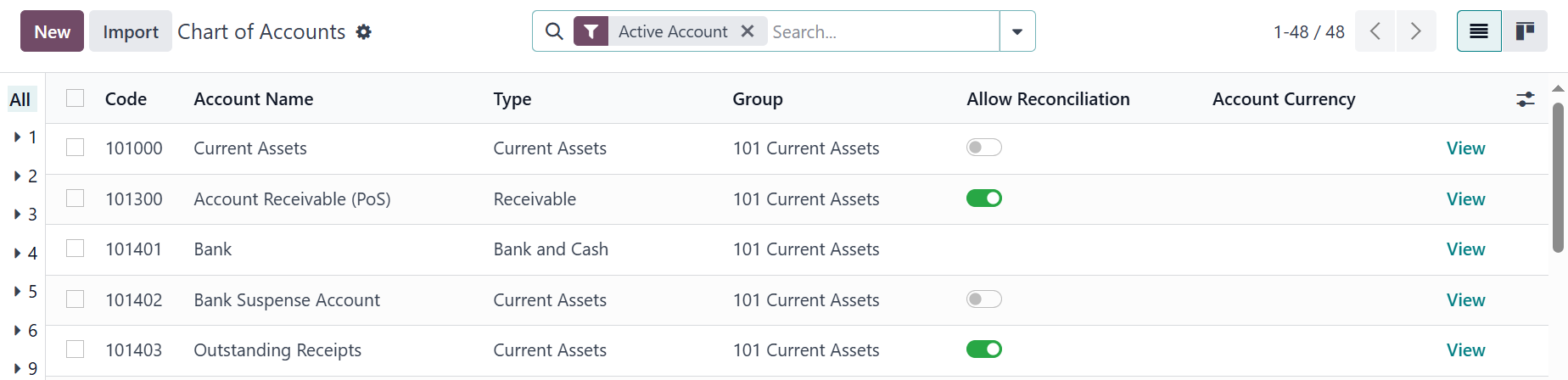

- Access the Chart of Accounts: From the main menu, select Accounting > Configuration > Chart of Accounts

- Create a New Account: Click on the "Create" button to add a new account to your Chart of Accounts. Fill in the details such as Account Name, Code, Type (Asset, Liability, etc.), and Default Taxes.

- Modify Existing Accounts: You can also click on an existing account to edit its details, including the account type, group, and more, or click on view button to edit further in detail.

Conclusion

Chart of Accounts is essential for effective financial management. It provides a structured way to categorize and track all financial transactions, ensuring that your business maintains clarity, compliance, and accurate reporting. By setting up a detailed and organized Chart of Accounts in Odoo, you can gain better insights into your financial data, streamline your reporting processes, and ensure that your business’s finances are always under control.